2024 Schedule 8812 – A bipartisan bill that just made its way through the House would expand the child tax service. Here’s what to know. . In 2021, the CTC was expanded after the passage of the American Rescue Plan. That year the tax was raised to $3,600 per child under the age of six, $3,000 per child between ages 6 to 17, and it was .

2024 Schedule 8812

Source : www.uslegalforms.comWhat is the IRS Form 8812? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com2023 Form IRS 1040 Schedule 8812 Fill Online, Printable

Source : 1040a-child-tax-credit.pdffiller.comUnderstanding IRS Form 8812 for Child Tax Credit in 2023 and 2024

Source : fox59.comSchedule 8812: Fill out & sign online | DocHub

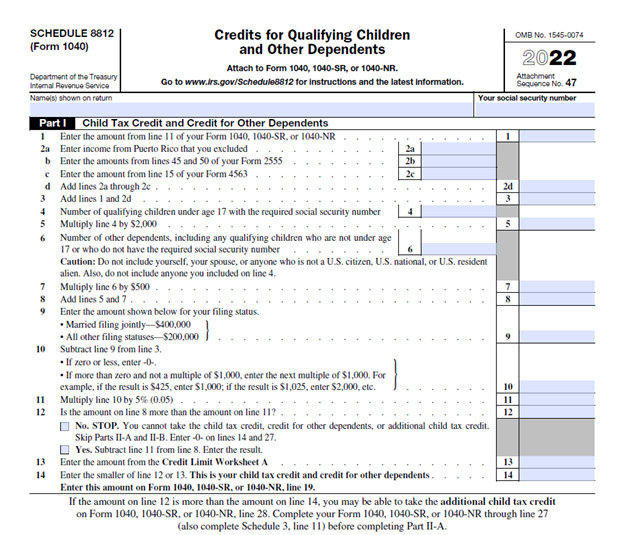

How to Complete IRS Schedule 8812

Source : www.taxdefensenetwork.comIRS 1040 Schedule 8812 Instructions 2021 2024 Fill and Sign

Source : www.uslegalforms.comMost Americans feel they pay too much in taxes, AP NORC poll finds

Source : suntci.com2011 2024 Form IRS 8812 Fill Online, Printable, Fillable, Blank

Source : irs-8812-fillable.pdffiller.comSchedule 8812 Instructions 2019 2024 Form Fill Out and Sign

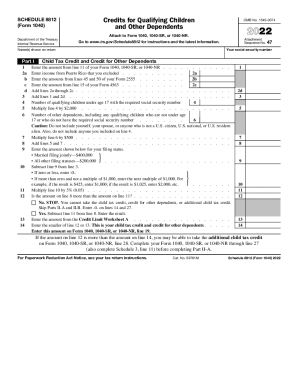

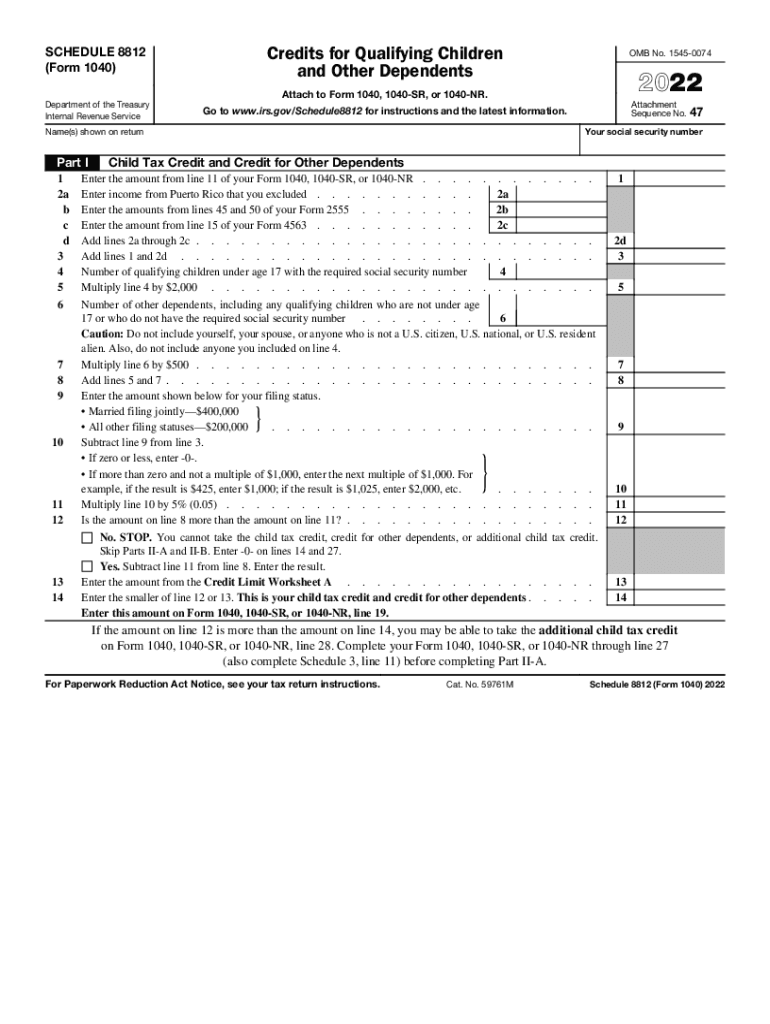

Source : www.signnow.com2024 Schedule 8812 IRS 1040 Schedule 8812 2022 2024 Fill and Sign Printable : If you owe less tax than the total of your CTC, you can use Schedule 8812 to claim up to $1,500 as a refundable credit through the Additional Child Tax Credit. • To qualify for the Child Tax . Tax filers use Schedule 8812 to calculate the credit. The child has to have lived with you for at least six months during the year. The child must be under age 17 at the end of 2023. What’s more .

]]>